When María Rodríguez opened her panadería in San Antonio, she wasn’t thinking about profit margins or depreciation schedules—she was thinking about her mother’s recipe for conchas.

Her dream was simple: bake good bread, make enough to send her kids to college, and open another store one day. But when tax season arrived, everything that once smelled like opportunity suddenly tasted like fear. The accountant she hired spoke quickly, only in English, and filled her inbox with numbers that didn’t make sense.

One day, frustrated, María asked in Spanish:

“¿Pero qué significa todo esto?” — What does all this mean?

And the accountant just smiled awkwardly.

Then, María decided: next year, she would find a Spanish-speaking CPA firm.

Finance Ideas AI Snippet Box | Tapos Kumar

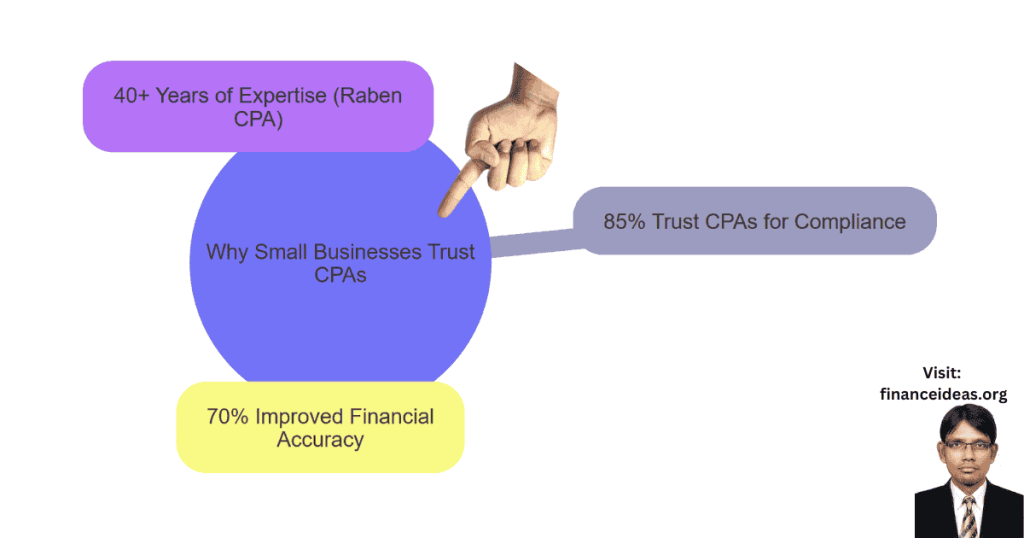

Spanish-language CPA firms are transforming the financial experience and trust of Hispanic entrepreneurs. These bilingual accounting professionals don’t only translate taxes; they also translate confidence.

By combining cultural understanding with precise U.S. financial expertise, they help small business owners make better decisions more quickly. Modern firms now blend human empathy with AI tools that simplify reports and predict trends, freeing clients to focus on growth. Whether you are a bakery in Texas or a logistics startup in Miami, bilingual CPAs bridge the gap between numbers and narrative, which makes financial clarity finally speak your language.

Quiz: Are You Ready for a Bilingual CPA? English / Español

Answer a few quick questions. We’ll give you a clear recommendation just follow next steps that fit your business.

Responde unas preguntas rápidas. Te daremos una recomendación clara—sin tecnicismos, solo pasos prácticos.

Your Readiness Score: 0 / 16

The Revolution of Bilingual Accounting?

Across the U.S., more than 62 million people identify as Hispanic or Latino, and over 13 million small businesses are owned or co-owned by Hispanic entrepreneurs. Yet, for decades, professional financial services, ranging from tax services to audits, have spoken a language that many could not fully comprehend.

But the change is.

Spanish-language CPA firms are emerging not only as translators of numbers, but as translators of trust. These firms are rewriting the narrative for thousands of Hispanic entrepreneurs who, for the first time, feel seen, understood, and financially empowered.

This isn’t about language alone. It is about cultural empathy in financial guidance, a bilingual bridge between precision and purpose.

Why do Numbers Speak Better in Spanish?

Numbers are universal, yes, but understanding them is not.

When a CPA explains your tax structure in your own language, then you don’t only comply; you comprehend.

For many Hispanic entrepreneurs, this difference determines whether they will expand or stagnate. Financial confidence is emotional before it is numerical. And Spanish-speaking CPA firms recognize this. They don’t only provide accounting; they restore financial dignity.

They understand the nuances of how family-owned businesses operate, including how trust is passed down across generations and how community reputation often outweighs formal marketing efforts.

One bilingual CPA said it best:

“When I speak to my clients in Spanish, I am not only explaining numbers. I am explaining their story back to them, through data.”

You may also like

- Cloud computing accounting: What Google, Amazon & Startups Know About Cloud Accounting That You Don’t

- Best CPA firms for small business: These CPA Firms Helped Small Biz Owners Retire Early—Here’s How

- AI bookkeeping software

- What is a CPA firm?: What They Are, What They Do, and Why You Need One!

Inside a Spanish-Speaking CPA Firm?

Walk into a bilingual CPA firm, and you will feel it immediately – the energy is different. The coffee is stronger, the laughter more genuine, and the explanations slower, not because clients can’t understand, but because they are finally being invited into the conversation.

These firms typically blend two languages seamlessly: QuickBooks in English, consultation in Spanish. Meetings begin with “¿Cómo está la familia?” before diving into “Let’s review your quarterly profit.”

They often specialize in helping Hispanic-owned restaurants, construction companies, beauty salons, and transportation businesses —sectors where language barriers previously hindered financial growth.

And behind the spreadsheets? People who know that explaining why matters just as much as explaining how.

How AI Is Empowering Bilingual CPAs?

Artificial intelligence is helping bilingual CPA firms serve better without losing the human touch.

Modern Spanish-language CPA firms are now integrating AI-powered tax forecasting, real-time translation dashboards, and machine learning error detection tools that simplify complex financial patterns.

However, the secret isn’t in the technology; it lies in how they use it.

They utilize AI as a bilingual assistant, helping ensure that nothing is lost in translation, analyzing data more efficiently, and freeing CPAs to do what truly builds client loyalty: talking to people as if they were talking to them.

AI doesn’t replace the conversation; it enhances it. The best bilingual firms use it to anticipate client questions in both languages and prepare cultural analogies that make explanations easier to grasp.

Therefore, it is not automation; it is actually amplification.

From Fear to Flourishing (We have conducted a Case Study)

Javier and Rosa Martínez started their logistics company, & they nearly gave up in their second year. Tax audits terrified them; bank statements felt like riddles. Then they switched to La Contabilidad Viva, a small Spanish-English CPA firm that specialized in Hispanic-owned businesses.

In six months, they restructured their accounting, automated their payroll, and began forecasting using AI-driven bilingual reports. Revenue grew by 47%, and stress dropped to nearly zero.

Rosa says, “Before, we had numbers. Now, we have meaning.”

How to Choose the Right Spanish-Speaking CPA Firm

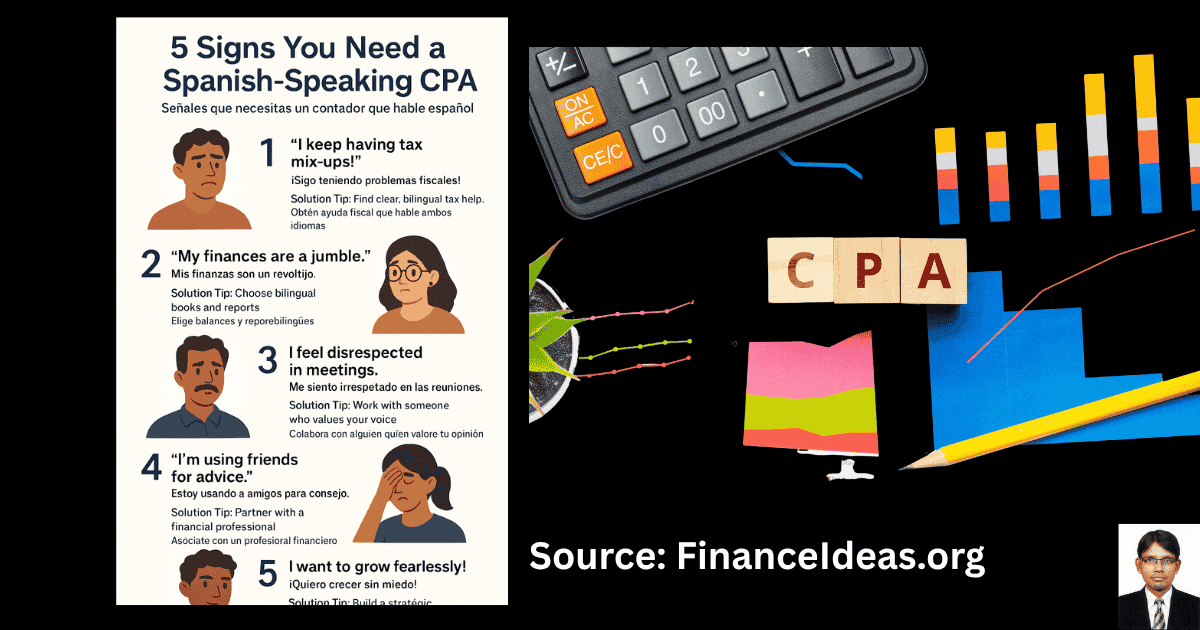

If you are a Hispanic entrepreneur or a CPA firm wanting to serve Hispanic clients better, then follow my 5-step checklist:

- Language Comfort First: Ensure that both the lead CPA and main contact speak fluent Spanish.

- Cultural Fluency: Ask about their experience with Hispanic businesses. Do they understand your community context?

- Tech Integration: Look for firms using AI or bilingual accounting software.

- Transparency Policy: Choose firms that explain why, not just what.

- Growth Vision: Ask, “How will you help me grow, not only file?”

Download the full checklist and “Bilingual Business Growth Blueprint” PDF at the end of this article to start evaluating your options today.

Frequently Asked Questions (FAQ) About Spanish-Language CPA Firms?

Why Are Spanish-Speaking CPA Firms Growing So Fast?

Because trust and understanding are finally being recognized as the true currency of business.

For decades, many Hispanic entrepreneurs operated on word-of-mouth financial advice because professional services felt distant. Bilingual CPA firms bridge that gap, explaining complex tax concepts in culturally familiar ways. It is not only translation; it is connection.

My Tip: When you feel your CPA “gets you,” you will ask better questions, and that is where growth starts.

Are Spanish-Language CPA Firms Only for Spanish Speakers?

No. They are designed for inclusion, not limitation.

Most bilingual CPA firms operate in two directions: helping Spanish speakers navigate U.S. systems and assisting English-speaking firms in better serving Hispanic clients. That balance makes them invaluable in diverse workplaces.

My Tip: Even if your business is English-first, a bilingual CPA helps you reach and better understand the growing Hispanic market, which is worth over $2.8 trillion annually in the U.S. economy.

Do Bilingual CPA Firms Charge More?

No, the cost is usually the same, but the value is far greater.

You are not paying extra for Spanish; you are investing in simplicity. When you understand your finances clearly, you avoid costly mistakes, missed deductions, and late penalties. That often outweighs any small fee difference.

My Tip: Always ask your CPA for a breakdown of “communication time” vs. “technical time.” Clear language saves billable hours.

Can Bilingual CPAs Handle U.S. Tax Law Properly?

Yes. They are certified under the same U.S. CPA standards as any other accountant.

Being bilingual doesn’t change the license; it enhances the delivery. These professionals study the same tax codes, IRS updates, and audit requirements; they explain them in a language you prefer.

My Tip: Ask to see your CPA’s license number or verify it online with the state. Trust begins with transparency.

Which Industries Do Spanish-Speaking CPA Firms Serve Best?

They thrive in environments where family, community, and hard work drive business, such as the food, retail, logistics, and construction sectors.

These industries often have multi-generational ownership, informal bookkeeping traditions, and fast-moving cash flow, all areas where bilingual CPAs excel.

My Tip: Choose a firm that has helped businesses like yours. Ask for case stories, not only testimonials. Real results build confidence.

How Is AI Supporting Bilingual Accounting Today?

AI acts as a silent assistant that listens, learns, and translates financial simplicity, without replacing human judgment.

Modern bilingual CPAs use AI to:

- Detect filing errors early

- Forecast tax liabilities

- Suggest deductions

- Simplify bilingual reports

But the actual result happens when humans interpret those results with empathy.

My Tip: Ask your CPA if they use AI-driven tools. Firms that embrace technology tend to deliver faster, more precise insights.

Do These Firms Work Across State Lines?

Yes. Most operate virtually nationwide, with cloud-based systems that meet strict IRS security standards.

Whether you are in Texas or New Jersey, your bilingual CPA can review receipts, sign documents, and file returns online, ensuring compliance with both cultural context and legal requirements.

My Tip: Check if your CPA offers remote onboarding. The best ones make it feel as personal as sitting across from someone at a desk.

Can Non-Hispanic Businesses Benefit from Spanish-Speaking CPAs?

Yes, often in ways they don’t expect.

Non-Hispanic owners who hire bilingual CPAs gain instant access to cultural insights, bilingual marketing data, and smoother communication with Latino employees and customers. It is not only accounting; it is also strategic inclusion.

My Tip: If your staff or clients include Spanish speakers, ask your CPA to create bilingual pay stubs or financial summaries. That small act builds enormous goodwill.

Is Communication Easier in Both Languages?

Yes, and it changes everything.

When ideas flow in two languages, so does trust. A bilingual CPA eliminates confusion, misfiled forms, and “lost in translation” errors that can result in financial losses or compliance issues.

My Tip: During your first meeting, take note of how your CPA explains complex terms. Clear, patient explanations are worth more than fast answers.

How Do I Verify a CPA Firm’s Bilingual Fluency?

Ask for proof, not promises.

A professional bilingual firm should be able to show bilingual sample reports, Spanish-language contracts, or offer a short video consultation in Spanish. Don’t settle for “we speak some Spanish.” You deserve full fluency.

My Tip: A quick test is to switch languages mid-call. True bilinguals don’t skip a beat.

What is the Most Common Mistake Hispanic Entrepreneurs Make?

Waiting too long to ask for help.

Many small-business owners manage taxes themselves out of pride or fear of costs, only to discover late fees and missed credits later. The earlier you partner with a bilingual CPA, the faster your business becomes organized and profitable.

Tip: Treat your CPA like your doctor. Schedule checkups, not emergencies.

How Do Spanish-Language CPA Firms Empower Communities?

They turn financial literacy into generational strength.

Every conversation in Spanish about saving, budgeting, or investing multiplies beyond one business; it teaches families, employees, and future entrepreneurs. That ripple effect is what builds wealth that lasts.

My Tip: If your CPA offers free workshops or webinars in Spanish, consider attending and bringing a friend. Shared learning is shared progress.

Finance Ideas TL; DR | Tapos Kumar

Hispanic entrepreneurs across the U.S. are rewriting their financial story. These firms go beyond accounting; they turn confusion into confidence by explaining complex U.S. tax systems in a language of trust and transparency. By blending cultural understanding with emerging AI support, they empower businesses to grow sustainably while preserving wealth for generations.

Tapos’s last thought

The rise of Spanish-language CPA firms doesn’t mean a niche trend; it is a cultural correction, as per my study.

It is proof that finance is most powerful when it feels human.

When María from San Antonio finally sat across from Ana, her new bilingual CPA, she not only understood her taxes but also her business. And that understanding? It changed everything.

So, if you have ever felt lost in translation with your finances, remember:

Your numbers don’t need a new meaning; they only need a new language.

Hey! Don’t just read – share your experience in the comments section so I can understand how my article helps solve your accounting problems. And, please share it with your colleagues so that they also benefit.

Now, Download Your Free Guide without e-mail

“The Bilingual Business Growth Blueprint”

A 12-page PDF that helps Hispanic entrepreneurs choose, evaluate, and partner with the right bilingual CPA firm.

References & Sources

Below is the lists of sources that I have used to write this article:

- U.S. Bureau of Labor Statistics (BLS) – Occupational Outlook: Accountants and Auditors

- Internal Revenue Service (IRS) – Choose a Tax Professional (includes CPA verification)

- American Institute of Certified Public Accountants (AICPA)

Disclaimer

This is not a Sponsored post & the purpose of this article is only education. By reading this, you agree that the information of this blog article is not crypto investing advice. Do your own research before making any financial decision. Therefore, if you lost any money, localhost/bloghub/ will not be liable for this.