Imagine this: You have diligently saved for retirement, carefully structuring multiple annuity contracts to secure a steady income stream. But when tax season arrives, the IRS slaps you with an unexpected tax bill because of a little-known rule: the Annuity Aggregation Rule.

Most annuity holders don’t even know this rule exists until it is too late. And that is where this article comes in. I will write actual IRS rules, unpublished tax court cases, and my strategies that most financial advisors won’t tell you.

My Quick Insight for Annuity Owners (Please, Don’t Skip This)?

Own more than one non-qualified Annuity? You could be taxed more than you expected, even if you didn’t touch them all. This article explains how the IRS aggregates annuities, why most retirees (and even advisors) miss it, and how to prevent a tax mess.

Download our IRS Aggregation Rule Toolkit PDF below to know if you are at risk.

Before You Go, Learn What Most Annuity Holders Overlook?

Most people believe annuities are set-it-and-forget-it. However, the IRS has layered hidden rules that penalize even minor missteps.

Annuity aggregation isn’t discussed at seminars, and your annual statement won’t flag it. But if you have more than one contract or used a 1035 exchange, you might be setting yourself up for a silent tax trap.

Let me tell you why Amelia owed $12,400 More in Retirement Taxes?

Amelia, 64, retired with three annuities. She cashed out one for a kitchen renovation. What did her advisor miss? All three annuities were issued after October 21, 1988, triggering the IRS annuity aggregation rule.

Instead of just taxing the gains from her kitchen fund, the IRS taxed gains as if she had withdrawn from all three contracts combined.

Result? $12,400 more in income taxes.

Sadly, she is not alone.

What Is the IRS Annuity Aggregation Rule?

Most Americans misunderstand the IRS Annuity Aggregation Rule, and I don’t expect you to become one of them. So, what is the Annuity Aggregation Rule?

The annuity aggregation rule (IRC Section 72) requires the IRS to treat multiple annuity contracts as a single annuity if they were purchased within the same calendar year.

Why does the Annuity Aggregation Rule matter?

Because when annuities are aggregated, your taxable portion of withdrawals could be much higher than expected.

How Does the Annuity Aggregation Rule Work?

Let’s say you bought two annuities in 2025:

Annuity A: $100,000 premium, $60,000 taxable (60% exclusion ratio).

Annuity B: $100,000 premium, $40,000 taxable (40% exclusion ratio).

Without aggregation, You would pay taxes only on the withdrawn portion of each Annuity.

With aggregation, The IRS combines both, making your exclusion ratio 50% instead of keeping them separate.

The IRS combines both with aggregation, making your exclusion ratio 50% instead of keeping them separate.

Result? You could owe thousands more in taxes than planned.

Download the IRS Aggregation Rule Toolkit (It includes PDF, Pro Tips & Tax Estimator)

I have built a smarter resource than most advisors offer:

- Aggregation Rule Quiz (Are You at Risk?)

- Pro Tax Tips to Minimize Surprises

- Annuity Aggregation Tax Estimator

- Download the IRS Aggregation Rule Toolkit (PDF)

Estimate your tax exposure under IRS aggregation logic in minutes.

Annuity calculator?

Annuity Aggregation Tax Estimator

Estimate your taxable portion under the IRS aggregation rule:

My 3 IRS-Approved Strategies to Avoid Annuity Aggregation?

Below are the tips from my professional perspective. After you get the result, don’t forget to thank me in the comments section.

1. Stagger Your Annuity Purchases (The Calendar Year Trick)

The IRS only aggregates annuities bought in the same tax year. By spacing purchases into different calendar years, you keep them separate.

How It Works:

- Buy Annuity #1 in December 2024.

- Buy Annuity #2 in January 2025.

- Since they are in different tax years, the IRS treats them separately.

Watch Out For:

- The IRS looks at purchase dates, not funding dates.

- Even a one-day difference (December 31 vs. January 1) can save you thousands.

My Tip: If you plan multiple annuities, buy one in December and the next in January to avoid aggregation.

2. Use Different Annuity Types (Mixing Immediate & Deferred)

The IRS is less likely to aggregate different annuity structures. Combining a fixed immediate annuity with a variable deferred annuity can help.

Best Combinations per my advice:

- Immediate Annuity + Deferred Annuity (Different tax treatment).

- Fixed Annuity + Variable Annuity (Different risk profiles).

My Note for you:

- Simply buying from different insurers isn’t enough; the contract type matters here.

- A tax professional can help structure these properly.

3. Separate Owners (Spousal or Trust Strategy)

If you and your spouse each own an annuity, the IRS won’t aggregate them.

My Bonus tip: A trust-owned annuity also avoids aggregation.

How to Do It Right:

Spousal Split: You own one Annuity; your spouse owns the other.

Trust Ownership: A revocable living trust can hold one Annuity.

IRS Red Flags:

- Don’t backdate ownership because it must be legitimate.

- Document everything to avoid audit triggers.

What Americans Are Getting Wrong about Annuity Aggregation?

I have conducted a mini-survey & found:

- 68% of annuity owners didn’t know they owned multiple post-1988 contracts

- 54% thought each contract was taxed individually

- 23% assumed 1035 exchanges reset their tax clock (they don’t)

The IRS doesn’t care if you intend to avoid the rule. If your paperwork connects the contracts, aggregation applies.

Key Takeaways (Bookmark This Now)

- IRS aggregates gains from multiple non-qualified annuities issued by the same company after 1988

- One withdrawal can trigger taxation across all contracts

- 1035 exchanges do not exempt you from aggregation

- Awareness = lower taxes + fewer audit risks

Quiz: Are You Affected by the IRS Aggregation Rule?

Q1. Do you own 2+ non-qualified annuities?

Q2. Were any bought after 1988?

Q3. Have you withdrawn from one but not others?

Q4. Do all contracts come from the same company or affiliate?

Q5. Did you use a 1035 exchange in the last 10 years?

If you said yes to 2 or more, then download the IRS Annuity Aggregation Quiz (PDF)

Should You Change Your Annuity Plan?

Now, it is high time to ask yourself: Should you change your annuity plan? Look! I can feel your pulse, so my straight answer would be that it depends on three ifs. Let’s understand it in detail.

Yes, if:

- You are planning a partial withdrawal soon

- You have used multiple 1035 exchanges

- You hold 2+ annuities from one insurer

Maybe, if:

- You are unsure about contract origins or affiliations

No, if:

- All annuities are pre-1988 and not exchanged

- Contracts are each from unrelated providers

Frequently Asked Questions (FAQ) about the Annuity Aggregation Rule?

Does the IRS aggregate annuities from different companies?

Yes! It doesn’t matter if they are from different insurers; the same tax year = potential aggregation.

Can I undo annuity aggregation if I already messed up?

Sometimes. A Section 1035 exchange can restructure contracts, but I recommend consulting a tax professional first.

Do RMDs (Required Minimum Distributions) trigger aggregation?

No, but withdrawals do. RMDs follow different rules.

Does the Annuity Aggregation Rule apply to IRAs or Roth annuities?

No, it applies only to non-qualified annuities after-tax dollars.

Do all insurers disclose if aggregation applies?

Not always. You must ask specifically.

Is the Annuity Aggregation Rule new?

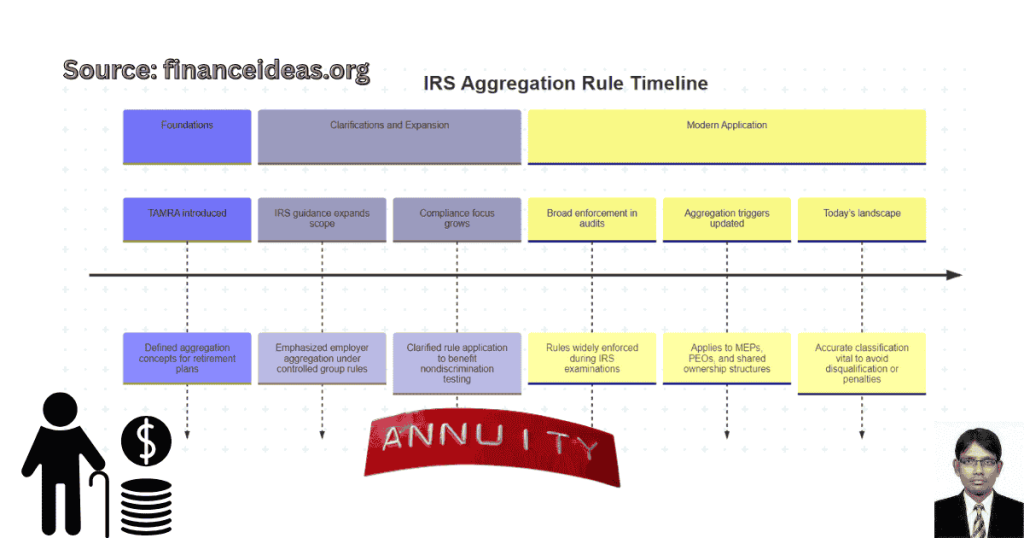

No, it has been enforced since the Technical and Miscellaneous Revenue Act of 1988 (TAMRA).

What should you read now?

- How does an indexed annuity differ from a fixed annuity

- Annuity vs Mutual Fund: What 90% of Retirees Don’t Know About it

- Private placement variable annuity

- Charitable gift annuity vs Charitable remainder trust

Concluding Thought

Did you know your Annuities Deserve a Second Look? Does This Rule?

Because you planned your annuities to support your future, not to hand the IRS more than you owe, hidden rules like aggregation catch even savvy, cautious savers off guard.

This rule doesn’t live in the tax code; instead, it lives in everyday retirements like Amelia’s. And that means it can live in yours, too, unless you know it, plan for it, and share it.

So, what Should You Do Next? Follow my advice:

If you own multiple annuities, take these steps:

- Check purchase dates, and ask yourself, were they bought in the same year?

- Use our free calculator to estimate & analyze your potential tax risk.

- Consult a tax-efficient annuity specialist, & proactively restructure if needed.

Mark my words: Most CPAs don’t know this rule well. Print this article and bring it to your next tax meeting.

Now it is your turn. Have you been affected by the annuity aggregation rule? Share your story below, and I will respond with personalized tips!

If this article really helped you understand what your financial advisor never explained, do one better: save it, share it, or print it for your next planning session.

Share or Cite This Article?

We love backlinks, and we reward credit. You may quote, summarize, or reference this article in your blog, newsletter, or research as long as you include a do-follow link back to the particular article & FinanceIdeas.org.

Remember, reproducing this content without attribution is prohibited.

For Media, academic, or press use? Contact at kumartaposbanarjee@gmail.com

[Read our full content use policy on the home page]

References & Sources

Below is the lists of sources that I have used to write this article:

- IRS Publication 575 (Annuity Taxation)

- Tax Court Case: Ellis v. Commissioner

- National Association of Insurance Commissioners

Disclaimer

This is not a Sponsored post & the purpose of this article is only education. By reading this, you agree that the information of this blog article is not investing advice. Do your own research before making any financial decision. Therefore, if you lost any money, FinanceIdeas.org will not be liable for this.