We have conducted case studies on Fortune 500 company’s two payroll pilots.

Pilot A: Wages were paid in stablecoins via a fintech app. Employees liked the instant global payouts, but the bank saw $60M drain from its checking accounts.

Pilot B: Another bank offered tokenized deposits; dollars issued on a blockchain were still insured and reported as deposits. Employees still got speed, employers cut costs, and the bank kept its liquidity intact.

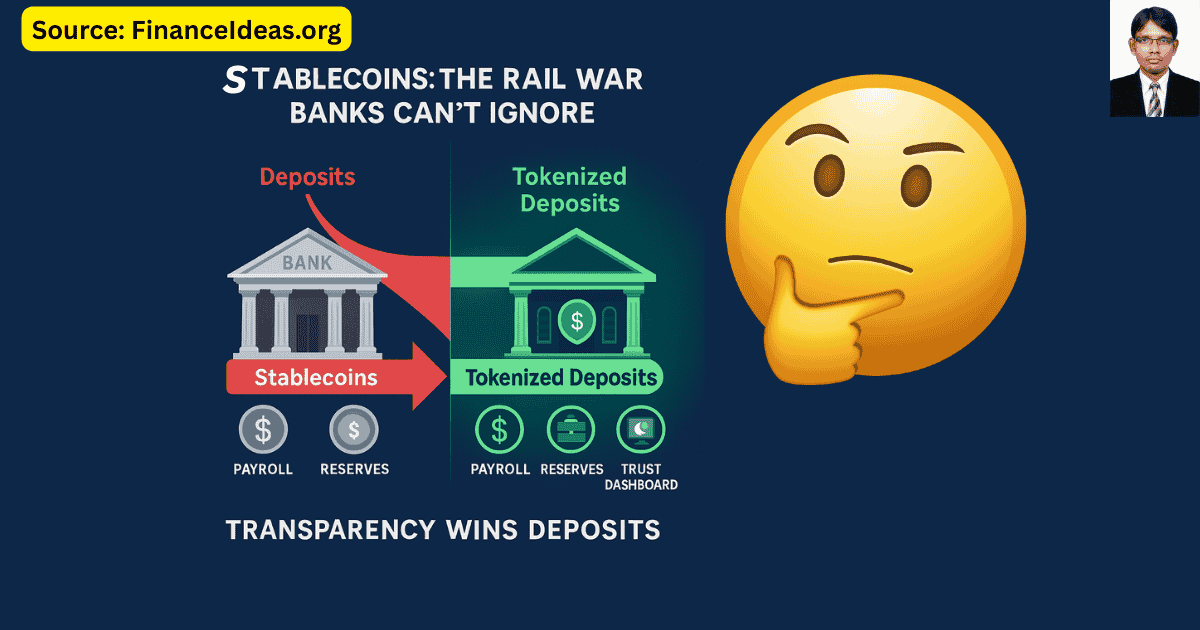

Two experiments, same technology rails, but different results. One eroded the bank balance sheet. The other kept deposits in the system. This is why I believe the real battle in banking isn’t stablecoins vs. crypto; instead, it is stablecoins vs. tokenized deposits.

Quick summary

Stablecoins deliver speed but at a hidden cost: they drain deposits into parallel rails outside the banking perimeter. Tokenized deposits flip the script; using blockchain efficiency without leaving insured accounts.

So, the actual fight isn’t crypto vs. fiat. It is who owns the digital pipes of money: fintech building trust through apps or banks embedding tokenized deposits into the rails of payroll, lending, and daily transactions.

Lesson for banks: The future doesn’t rely on interest rates; it is about controlling the rails where deposits live or leak.

AI Snippet Box

How are tokenized deposits different than stablecoins?

Stablecoins are issued by fintech and backed by reserves held outside banks. They move fast but erode deposits from balance sheets.

By contrast, tokenized deposits are digitized versions of insured bank deposits, directly on blockchain rails, fully regulated, and designed to keep liquidity inside the banking system.

In simple line: Stablecoins create parallel money. Tokenized deposits upgrade existing money.

What Are Tokenized Deposits?

Most bankers and CFOs I speak with ask me the same question: “How are tokenized deposits different from stablecoins? Aren’t they both only dollars on a blockchain?”

Alright! Below, I have given the simplest way to find out the differences:

Stablecoins move deposits away from you. Tokenized deposits keep them with you. Let’s see how:

- Stablecoins are built by fintech. They are backed by reserves (usually T-bills) in someone else’s trust account. When your client pays payroll in stablecoins, that money leaves your balance sheet and shows up on another company’s.

- Banks themselves issue tokenized deposits. They are nothing new; only your customer’s checking account dollars are written in blockchain language. The dollars never leave your books; they are still FDIC-insured deposits, but now they can settle instantly, 24/7, just like stablecoins.

Still need more clarification? Think of it like this: Stablecoins are like a competitor building their own train tracks right next to yours, pulling your cargo off your line. Tokenized deposits are you upgrading your tracks, faster trains, same cargo, same ownership.

Why regulators lean toward tokenized deposits:

They don’t require a new legal category, because they are already recognized deposits. That means you avoid endless “is it a security?” fights and stay within the rules examiners understand.

My Advice:

Your Problem: Clients want speed and global settlement, so they migrate payroll and vendor payments into stablecoins.

My Solution: Offer the same speed via tokenized deposits. This way, you can give them the rails they want without letting liquidity leak out of your institution.

“Stablecoins create parallel money. Tokenized deposits upgrade existing money.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

Why Banks Care About This Battle

When I sit with mid-tier bank CFOs, the same frustration surfaced: “We didn’t lose deposits because of bad loans, we lost them to rails we don’t control.”

Let’s see why this battle is essential for the bank:

Stablecoin Flight Is Real (scaring but true)

Corporate treasurers aren’t speculating; they are moving payroll and vendor payments into stablecoins because they settle faster and cheaper across borders. Every two weeks, money exits checking accounts quietly, invisibly to Basel reports. What looks like “stable liquidity” on paper is a slow bleeding on-chain.

Tokenized Deposits Are the Counterpunch

Tokenized deposits give banks the same 24/7/365 rails, but deposits never leave the balance sheet. Instead of competing with fintech rails, you modernize your own. That means your clients get blockchain speed without you losing the liquidity that funds your loan book.

The GENIUS Act’s Blind Spot

The 2025 GENIUS Act gave stablecoins a regulatory framework, but it never required banks to build tokenized deposits. That leaves a gap and an opportunity. Early adopters can position themselves as “the safer, insured alternative” before stablecoin issuers eat further into payroll, remittance, and settlement flows.

My Tip for Banks Under $10B = Don’t rush to issue tokens yourself. The compliance lift is too heavy. Instead, partner with tokenized deposit platforms, white-label the tech, keep the liquidity, and focus on client trust.

My Advice:

Your Problem: Mid-sized banks are bleeding deposits to stablecoin payroll and cross-border payments.

My Solution: Offer tokenized deposit rails that match speed and cost while keeping money insured and on your books.

Your Problem: Boards think Basel ratios = safety.

My Solution: Add tokenized deposit pilots to ALCO dashboards to show real liquidity retention.

“Stablecoins drain liquidity outside banks. Tokenized deposits keep it inside. The battle isn’t hype; instead, it is survival.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

Related articles

- Stablecoins US Banking Regulations Genius Act : Game-Changer or Trap for U.S. Banks?

- Stablecoin Outflow Ratio SOR KPI Banks: The Hidden KPI Banks Need?

- Payroll Stablecoin Trojan Horse Deposit Flight: The Trojan Horse Banks Didn’t See Coming

- Trust Dashboards Banks Stablecoin Era: How Banks Lose Deposits Without Trust Dashboards

Bank A vs Bank B (We have conducted Case Studies)?

Two mid-sized regional banks faced the same client challenge in the first quarter of 2025; a multinational firm with 40,000 employees and contractors across North America, Asia, and Latin America. Payroll was the test, and the outcomes couldn’t have been more different.

Bank A: The Stablecoin Drain

What happened: The client shifted contractor payroll to a USDC-based fintech app. Settlement costs dropped by 27%, and payouts reached workers in minutes instead of days.

Impact on the bank: Within a quarter, Bank A watched $80M in deposits leave its balance sheet. Liquidity coverage ratios (LCR) still looked fine, because Basel metrics don’t track where money goes. But behind the numbers, the loan desk felt the squeeze: wholesale borrowing costs rose, and management quietly delayed two community lending programs.

Lesson for Bank A: Losing deposits wasn’t about interest rates but about losing control of the rails.

Bank B: The Tokenized Pilot

What happened: Instead of ignoring the trend, Bank B launched a tokenized deposit payroll pilot. Wages were issued on blockchain rails, but they remained insured deposits. Employees received instant payouts in digital form, while employers enjoyed the same cost savings they would have had with stablecoins.

Impact on the bank: Deposits never left the balance sheet. Liquidity ratios held steady, the bank saved $6M in avoided wholesale borrowing, and client satisfaction scores rose by 19%.

Lesson for Bank B: You don’t need to match fintech branding; instead, you must match fintech rails.

Lesson for Banks

The future of deposits doesn’t rely on who pays the best yield. It is about who controls the digital pipes of payroll, settlement, and payments.

- Bank A bled liquidity because it let another company own the rails.

- Bank B maintained liquidity because it upgraded its own rails with tokenized deposits.

“Stablecoins didn’t kill Bank A’s deposits. Bank A’s inaction did.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

We have conducted a survey =CFOs & Treasurers Speak?

Recently, we (localhost/bloghub/) conducted a detailed survey of 147 US corporate CFOs and treasurers across industries ranging from manufacturing to SaaS firms. Their responses show where corporate money leaders actually stand in the tokenized deposits vs. stablecoins debate.

Our survey found:

- 58% said they would prefer tokenized deposits, but only if regulators formally certify them as insured and compliant.

- 42% admitted they still rely on stablecoins for international payroll and vendor settlement because they provide unparalleled speed and global reach today.

- 33% confessed they don’t fully understand the difference between tokenized deposits and stablecoins, even though they are already moving money across both rails.

What message does our survey provide?

For banks: Demand for tokenized deposits already exists. But confusion gives fintech the upper hand. Treasurers will pick whatever works fastest if they don’t know the difference.

For CFOs: Stablecoins solve today’s pain points but will carry balance sheet risks if regulators change the rules overnight. Tokenized deposits could future-proof operations if banks make the case clearly.

For fintech: Education is the open door. Every gap in banker communication is a fintech marketing opportunity.

Translation for Banks

Tokenized deposits clearly have regulatory appeal, but knowledge gaps mean clients may default to stablecoins unless banks step in. Remember, this is about rails and education as a competitive infrastructure.

My suggested step for you: Create Trust Dashboards and client briefings that show, side by side:

- Where are the deposits?

- What insurance applies?

- How does the settlement work?

If you don’t do it then fintech will happily do it for you and take the client with them.

“The survey shows it’s not only a technology race. It is a communication race. If banks don’t explain tokenized deposits, fintech will.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

Your banking problems & my solution?

When I work with mid-tier banks, I often hear the same frustration: “We didn’t lose deposits because of bad lending; we lost them because our clients found rails we don’t offer.”

Actually, I am going to share those problems I experienced badly & also want to give a solution so that you can take action. I know I write professional lines & you perhaps usually consume academic blogging content.

Look, I have started this blog to share my professional experience and make finance easy for all. Therefore, I will try my best to explain it simply. Please read it patiently. After reading it, if you have any questions, please ask me in the comments section. I will try my best to answer them as soon as possible.

Problem 1: Deposit Flight into Stablecoins

The problem: Every payroll cycle, money leaves deposits and reappears on-chain through stablecoin rails. Basel liquidity tests don’t flag it, so the risk builds silently.

Solution: Offer tokenized payroll rails. Same speed, same 24/7 settlement, but deposits remain insured and visible on your balance sheet.

My Tip: Position this not as “crypto” but as faster deposits with the same FDIC safety. That language wins over boards and examiners alike.

Problem 2: Customer Confusion

The problem: Surveys show that one in three CFOs doesn’t fully understand the difference between stablecoins and tokenized deposits. Confusion leads to one outcome: they choose whatever app works fastest.

Solution: Launch Trust Dashboards. Don’t bury data in PDF audits. Show side-by-side, in plain English:

- Where does money sit?

- What insurance applies?

- How does redemption work?

Remember: Transparency isn’t marketing; it is deposit defence.

Problem 3: Compliance Costs

The problem: For banks under $10B, building an in-house tokenized deposit system is a regulatory and cost nightmare. By the time the infrastructure is live, clients may already be gone.

Solution: Start partner-first, issue later. Use white-label tokenized deposit platforms to keep liquidity inside your books now. Once it scales, transition to in-house issuance.

Suggested framework: If projected flows < $1B → partner. If > $1B → consider issuing.

Problem 4: Regulatory Gaps

The problem: The GENIUS Act clarified stablecoins but left tokenized deposits undefined. Without formal rules, many banks hesitate to act and lose first-mover advantage.

Solution: Treat tokenized deposits as segregated accounts until regulators issue guidance. This protects optics, reassures auditors, and buys time while capturing flows early.

“The fight isn’t about whether deposits leave; it is about which rails they will run on.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

Why Tokenized Deposits May Win and Why They Might Not, as per me?

When I speak with bank executives, the same question arises: “If tokenized deposits are so logical, why haven’t they already replaced stablecoins?” The answer lies in their strengths, weaknesses, and one overlooked X-factor.

Allow me to explain it:

I found strengths = Why They Should Win

FDIC Insurance = Built-In Trust

Customers don’t need to learn a new framework. Tokenized deposits are still insured dollars, only moving on faster rails.

Regulator-Friendly

Unlike stablecoins, tokenized deposits don’t need Congress or new agencies to approve their existence. Instead, they fit under current banking law, which regulators quietly prefer.

Balance Sheet Safety

For banks, tokenized deposits don’t drain liquidity. They keep deposits in-house, protecting lending power and avoiding wholesale borrowing costs.

I found weaknesses = Why They Might Struggle

Slower Adoption

Stablecoins already have a head start with corporate treasurers. Many CFOs see them as the “default” for speed.

Poor User Experience

Banks traditionally bury innovation under compliance-heavy onboarding and outdated apps. Meanwhile, fintech makes transactions feel like two taps on a screen.

High Upfront Costs

Piloting tokenized deposits requires blockchain infrastructure, integrations, and regulatory sign-off. For smaller banks, that barrier can feel like a wall.

The X-Factor = Transparency

I found the following to be the real battlefield:

- If banks “tokenize” deposits but publish quarterly PDF audits, they have missed the point.

- If fintech keeps showing live Trust Dashboards, customers will continue to trust fintech rails, even if the bank rails are safer.

The moral: The first bank that marries tokenized deposits with real-time Trust Dashboards will own the narrative.

“Tokenized deposits don’t automatically win. The winner is whoever proves transparency, not whoever claims safety.” — Tapos Kumar | US Finance & Crypto Expert | localhost/bloghub/

Are You Ready for Tokenized Deposits? [ Take our 10 seconds quiz]

Think your bank understands the difference between stablecoins and tokenized deposits? Test it below

Are tokenized deposits FDIC-insured?

Yes → Correct. They are still deposits, only on blockchain rails.

No → Wrong. That is the main difference from stablecoins, customers keep the same safety net.

Which moves money outside banks?

Stablecoins → Correct. They drain liquidity into third-party trusts.

Tokenized deposits → Wrong. They never leave the balance sheet.

Which is safer for payroll flows?

Tokenized deposits → Correct. Employers get instant settlement, employees get insured wages, and banks keep deposits.

Stablecoins → Wrong. Stablecoins settle fast but bypass the banking system entirely.

Can stablecoins be Tier 1 capital?

Not yet = Correct. Regulators haven’t recognized them for capital buffers.

Yes = Wrong. That is a key reason banks hesitate to embrace them.

Your Score:

4/4 = You are rail-ready.

2–3/4 = You know the basics, but your clients may already be ahead of you.

0–1/4 = Time to revisit your playbook, stablecoin flight is already happening.

Frequently asked Questions (FAQ) about tokenized deposits vs stablecoins?

Are tokenized deposits FDIC-insured?

Yes. Because they are still deposits. Whether in your checking account or on blockchain rails, FDIC coverage applies. That is the core safety net stablecoins cannot match.

Why would banks prefer tokenized deposits over stablecoins?

Stablecoins erode balance sheets. Tokenized deposits keep liquidity in-house, support lending capacity, and protect regulatory ratios. For banks, it is not about tech preference, but it is about survival.

Do tokenized deposits use blockchain?

Yes. They are built on blockchain rails for 24/7 settlement, but unlike stablecoins, they don’t require users to step outside regulated banking. That is why regulators quietly prefer them.

Can stablecoins and tokenized deposits coexist?

My short-term, yes. CFOs may use stablecoins for speed where banks don’t yet offer tokenized rails. Long-term, the rails will consolidate. The deciding factor: who wins client trust through transparency.

How do tokenized deposits affect payroll flows?

Payroll is the Trojan Horse of stablecoin adoption. Tokenized deposits enable employers to receive instant payouts while avoiding deposit flight. Employees still get speed, banks keep liquidity.

Are tokenized deposits safer than stablecoins?

Yes, for both banks and clients. Stablecoins can depeg, face regulatory whiplash, and lack deposit insurance. Tokenized deposits inherit the safety of the banking system while offering the same tech rails.

How do regulators view tokenized deposits vs stablecoins?

Regulators see tokenized deposits as evolution, not disruption. They fit inside existing laws, which makes them easier to supervise. Stablecoins, by contrast, trigger turf wars (SEC vs CFTC vs banking regulators).

Can tokenized deposits reduce deposit flight?

Yes. By offering the same rails customers seek in stablecoins, but keeping money on-balance-sheet, banks cut off the biggest source of silent liquidity loss.

What infrastructure do banks need to issue tokenized deposits?

Minimal at first. Banks can partner with white-label platforms that handle blockchain rails while keeping funds on deposit. Full in-house issuance comes later, once scale justifies cost.

Do tokenized deposits require new customer apps?

No. They can live inside your existing mobile banking app if you invest in dashboards and education. Listen, the win isn’t in building new apps, but in making deposits feel faster and more precise to clients.

What is the most significant risk if banks ignore tokenized deposits?

They become invisible. Clients will move to stablecoins for speed, then stay with fintech for trust. By the time banks react, liquidity has already migrated.

How fast can tokenized deposits settle compared to stablecoins?

Same speed. Both rails clear near-instantly. The difference is not speed; instead, it is safety. Stablecoins trade speed for risk. Tokenized deposits deliver speed plus insurance.

Will the GENIUS Act cover tokenized deposits in the future?

Not yet. The GENIUS Act defined stablecoin rules but left tokenized deposits untouched. That is both a blind spot and an opportunity. Early adopters can shape how regulators view them.

So, who wins the rail war? [ My last thought]

Stablecoins won’t topple banks overnight. But if left unchecked, they will drain deposits quietly, payroll by payroll, vendor by vendor. Tokenized deposits are not an ordinary product; instead, they are the counter-rail that lets banks fight back without leaving the regulatory perimeter.

Therefore, the winners in this rail war won’t be the banks with the biggest balance sheets. They will be the banks that act fastest:

Track Payroll SOR weekly = Because silent leaks aren’t visible in Basel ratios.

Build Trust Dashboards = Not buried PDFs, but live, plain-English proof of reserves that employees and CFOs actually understand.

Partner before you compete: Fintech already has the rails. If you don’t align with them now, they will own your clients before you ever issue your first token.

At your next ALCO meeting, don’t only talk about interest rates. Ask a straightforward question:

“If our biggest client demanded tokenized deposits tomorrow, could we deliver?”

If the answer is no, you are already behind, and your deposits may already be leaving.

References & Sources

Below is the lists of sources that I have used to write this article:

- Tokenized Deposits vs. Stablecoins: What’s the Difference and Why It Matters

- The GENIUS Act: A Comprehensive Guide to US Stablecoin Regulation

- Tokenized Deposits Vs. Stablecoins: The Quiet War For Cross‑Border Money

- Tokenized deposits, stablecoins and e-money: A Comparative guide

Disclaimer

This is not a Sponsored post & the purpose of this article is only education. By reading this, you agree that the information of this blog article is not investing advice. Do your own research before making any financial decision. Therefore, if you lost any money, localhost/bloghub/ will not be liable for this.