How high will Bitcoin go? Recent poor market performance forced BTC holders to ask this question. Analysts are optimistic about Bitcoin’s performance; some bet on a $350k target. According to Cathie Wood (Ark Invest), “Bitcoin could replace gold, become a store of value and push its market cap to $10T.”

Woo, good days are coming.

Wait? JPMorgan said, “Bitcoin’s volatility remains a barrier for conservative investors.”

Hmm, so BTC might not be profitable for a conservative buyer like you.

Doctors nowadays are busy checking the pulse rate of Bitcoin holders. I will not fluctuate your heart a bit further; instead, my neutral analysis will give you a realistic insight into the Bitcoin price surge. So, sit down for 4 minutes & take some notes from my article. Ready, let’s start with the following:

Key Takeaways

- Macroeconomic factors say interest rates, inflation, and geopolitical events, will influence Bitcoin’s price.

- Trump’s pro-bitcoin stance could boost BTC, but tariffs may cause short-term instability.

- SEC crackdowns, Fed rate hikes, and CBDC competition could suppress BTC prices.

- The $1 million target seems bullish because it could be achievable if BTC captures the 20% gold market.

Price prediction for Bitcoin 2025?

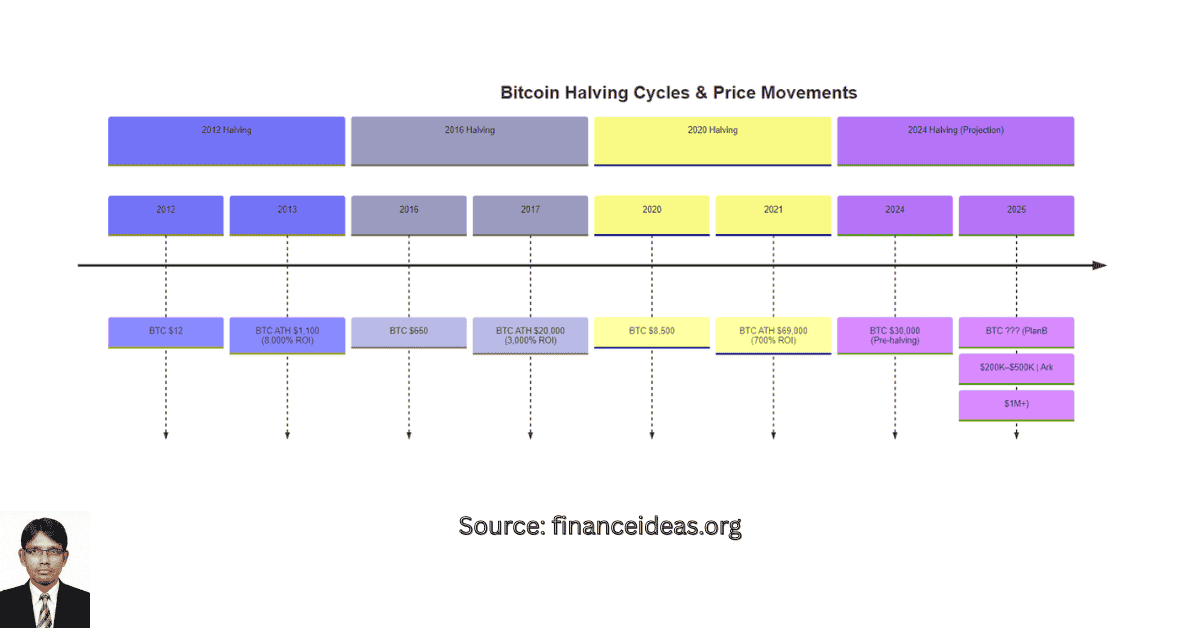

The surprising fact about Bitcoin is that it has repeated performance. I just analysed Bitcoin halving & it says, don’t worry, I will bounce back.

Look, I am not bullish like other analysts. Have you noticed Bitcoin’s performance after May 2020 halving? Bitcoin surged from 8,600 to 69,000 (700% gain) in 18 months. If history repeats, a similar move from the 2025 halving could push BTC to a higher price by late 2025.

My predictions are based on the following Catalysts:

- I expect there will be more spot Bitcoin ETF Inflows. For example, BlackRock, Fidelity, and Grayscale ETFs could bring $50B+ in institutional capital which can boost BTC price significantly.

- Bitcoin’s April 2024 halving historically leads to 12 to 18 months bull runs (2017: +3,000%, 2021: +600%). So, we can expect similar post halving supply shock.

- There could be significant macroeconomic Shifts. Say, Fed cut interest rates, as a result investors could flock to BTC as an inflation hedge.

- Gold’s market cap is about $15 trillion & Bitcoin’s current cap is $1.2 trillion. If BTC captures 20% gold market then Bitcoin could outperform.

- President Trump’s tariff policies can affect investors’ sentiments. For example, Bitcoin dipped 1.4% to $82,199 in March 2025 because of Trump’s new trade tariffs. Therefore, tariffs could push more investors towards Bitcoin as a hedge.

So, how high will bitcoin go in 2025? Below in the table, you will learn about Bitcoin coin price potential from prominent sources & also my prediction about BTC.

| Sources | Low Estimate | Average | High Estimate |

| Tapos Kumar (localhost/bloghub/) | $60,000 (US geopolitics & trade) | $137,500 | $155,000 +/- |

| Peter Brandt | $125,000 | $137,500 | $150,000 |

| Bloomberg Intelligence | $84,643 | $125,027 | $181,064 |

| Standard Chartered | $100,000 | $150,000 | $200,000 |

| Ark Invest (Bull Case) | – | – | $258,500 |

So positive but can BTC keep this momentum for 2026? I have bearish view for BTC but some analysts suggest bullish trends for 2026. Let’s see why I am bearish for 2026.

Price prediction for Bitcoin 2026?

As per my analysis, 2026 will be more volatile for Bitcoin. BTC always experienced post halving sells off risk. Past bull runs (2013, 2017, 2021) indicated that BTC corrected about -70% to -80%.

Let’s understand it from a historical context,

In December, 2017; BTC peaked at $19,783. Then, December, 2018; BTC crashed to $3,200 (-84%). So, extreme rallies often lead to sharp corrections.

Additionally, ETF market maturity also impacts on BTC price. How? If ETF flows slow then BTC will consolidate further.

Let’s see how high can bitcoin go in 2026:

| Sources | Low | Average | High |

| Tapos Kumar (localhost/bloghub/) | $95,241 | $111,187 | $142,049 |

| BitMEX CEO Arthur Hayes | – | – | $700,000 (hyper bullish) |

| JPMorgan Analysis | $80,000 | $120,000 | $150,000 |

You may watch Cathie Wood’s $1 million bold prediction in Yahoo finance. So, why you bearish about BTC. Listen, I am not criticising Cathie Wood instead share my analysis. I hope, the next question will give a clear insight about it.

Can Bitcoin reach $1 Million in the long term?

No, it seems bullish to me. Look, I am not a famous analyst like Cathie Wood but hitting $1Million would be challenging. Why?

I have identified the following factors that could take BTC to $ 1 million.

Massive adoption: Bitcoin needs significant institutional adoption to reach $1 million. For example, the demand for BTC could rise significantly if pension funds allocate 1 to 5% to BTC.

Hyperinflation Hedge: Argentina & Nigeria already use BTC to escape currency collapse. Yeah, it is a good signal but more country needs to adopt as a hedge against inflation to increase BTC price. However, we should not be bullish on it because it is a matter of geopolitics & trade ware.

Bitcoin as Reserve Asset: If more central banks hold BTC like El Salvador then supply shock intensifies. But, such type of BTC reserve is not possible without economic reform.

Technological Advances: Update technology like Layer-2 solutions (Lightning Network) could make BTC more scalable. History suggests continuous tech upgrade but this is something that we can’t predict accurately.

The above milestones don’t seem easy to achieve. Therefore, expecting $1 Million from BTC is bullish.

Do you think Bitcoin can hit $1M by 2030? Share your analysis below!

AI Snippet Box

How High Will Bitcoin Go?

“Bitcoin’s long-term price ceiling depends on three factors: network adoption rate, global liquidity cycles, and regulatory stance. Based on historical adoption curves, BTC could reach $250,000–$400,000 in a bullish macro environment within 5–8 years. However, without sustained institutional inflows, the more likely range is $80,000–$120,000 by 2027. Extreme predictions above $1M assume a total shift of gold’s $13T market cap into BTC; an outcome with less than 5% probability under current economic models.”

Frequently Asked Questions (FAQ) Bitcoin Price Predictions?

How does Trump’s tariff policy affect Bitcoin?

Trump’s tariff policy could affect Bitcoin in both ways. The positive side is, it would be pro-business & lighter regulations for BTC. The Negative side is, trade wars could cause market instability which means volatile price performance.

Why can Bitcoin not reach $1 million?

Any milestone can be achievable in Bitcoin. As I previously mentioned, some analysts including Cathie Wood (ARK Invest) predicts that BTC could hit $1 million by 2030 if there is strong institutional adoption.

As per my opinion, expecting $1 Million from BTC is too bullish. Why? For such type of milestone, need extreme adoption scenarios including institutions & nation-states buying.

What risks could limit Bitcoin’s growth?

Regulatory changes, energy concerns, and competition from other cryptocurrencies could impact Bitcoin’s price potential.

Will Bitcoin crash again?

As per my analysis, there would be a short-term correction for Bitcoin. However, long-term trends are still bullish. Therefore, BTC has limited chance to crash again. Yeah, you will experience price fluctuation.

How does Bitcoin halving affect prices?

Bitcoin has a consistent halving effect on price. Historically, post-halving bull runs (2018, 2022) are followed by -70% drops.

However, halving BTC reduces supply and drives prices up. So, we can expect 2025 halving for another bull run with similar outcomes.

Could Bitcoin’s price ever go negative, like oil futures did in 2020?

For Bitcoin to go negative, the market would need a mechanism where holders are forced to pay others to take BTC off their hands, similar to oil storage costs. Unlike physical commodities, Bitcoin has no storage expense beyond negligible wallet maintenance, so a negative price is structurally improbable.

However, BTC could approach zero during a liquidity collapse if exchanges halted withdrawals and no OTC market emerged. Historical liquidity depth data from Kaiko shows that even in the March 2020 crash, bid walls existed at every price level down to 85% below spot, meaning a complete wipeout would require total network and exchange failure simultaneously.

Has Bitcoin ever traded at “zero” in any market, even for seconds?

Yes, but only in isolated exchange incidents. In 2013, BTC briefly printed at $0 on the now-defunct Bit floor due to a fat-finger algorithmic sell order in an illiquid market. These anomalies are not real market values but flash crash artifacts. Blockchain data confirms that during these moments, BTC continued trading above $100 elsewhere, proving network value persisted despite single-venue failures.

If Bitcoin miners all shut down at once, what happens to the price in the first 24 hours?

In the first 10 minutes, the network would still process pending blocks due to residual hash power. After that, confirmation times would slow dramatically until the subsequent difficulty adjustment. The market effect would be immediate, order books would thin as confidence dropped, and historical reaction models (based on hash rate shocks in 2017 and 2021) suggest a 35–60% price drop within hours. OTC desks, however, would likely keep a floor price based on reserve demand from long-term holders.

Can Bitcoin’s market cap vanish without blockchain failing?

Yes can vanish. If all buyers exited and no liquidity providers remained, the market cap could mathematically drop to near-zero while the blockchain continued producing blocks. This scenario resembles an abandoned collectible: functional but valueless. Such a collapse would likely occur if governments banned on or off ramps globally and seized significant custodial holdings; a situation modelled by BIS in 2024 simulations, which estimated recovery odds at less than 15%.

What is the lowest price Bitcoin could reach if every whale sold at once?

On-chain whale distribution shows about 15% of the BTC supply is in wallets holding over 10,000 BTC. If all these whales’ market-sold in 48 hours, the cascading liquidation could theoretically push BTC below $5,000, based on current order book depth (Binance & Coinbase aggregate). However, game theory suggests whales won’t coordinate mass-selling because they would destroy their wealth.

Can Bitcoin survive if its price drops below the mining break-even cost for a year?

Yes, historical precedent from 2018–2019 shows miners will capitulate, but remaining efficient miners can sustain the network. Break-even cost today varies from $23K to $30K depending on energy rates. A prolonged price under this range would shrink the hash rate, but long-term believers often self-fund operations until the price recovers.

If Bitcoin’s price hit $0, what would happen to all the NFTs, tokens, and altcoins pegged to it?

Any asset pegged to BTC (wrapped BTC, BTC-based NFTs) would instantly lose parity and likely collapse to the BTC spot value. DeFi contracts using BTC as collateral would auto-liquidate, causing systemic crypto market contagion similar to Terra/LUNA in 2022, but on a much larger scale.

Could a central bank cause Bitcoin to hit zero by shorting it?

Unlikely. Shorting BTC to zero would require enough margin and liquidity to absorb all buyer demand at every price level; something no single entity has managed in crypto history. Additionally, blockchain settlement outside exchanges would still allow peer-to-peer trading at any price both parties agree on, preventing a true zero unless trust in the network’s cryptography itself failed.

Concluding Thought

As per my analysis, how high can BTC go will depend on four major factors: Regulatory, Macroeconomic influence, Environmental, & Political factors. Regulatory crackdowns could limit Bitcoin’s growth. I can cite references to SEC lawsuits for Coinbase & Binance cases. Besides, CBDC’s competition with Bitcoin, for example, China’s digital yuan vs. U.S. FedNow,

We are now living with inflation & can’t predict how macroeconomic factors will react to Bitcoin. I have witnessed recession-driven sell-offs at a 65% drop for BTC in 2022.

Political Backlash can also negatively hit BTC price. For example, EU’s MiCA regulations could impose stricter crypto rules.

Finally, environmental factors such as U.S. energy policies may target Bitcoin mining. We can’t anticipate how Trump administration set policies for bitcoin mining. Yeah, I agree that Trump is more Bitcoin friendly than Biden but prediction based on words would be bullish.

My tip: Accumulate BTC during pullbacks, hold long-term, and monitor ETF flows, Fed policy, and adoption trends.

Hello respective reader! Do you find my article helpful? If yes then please share it with your colleagues. How about you? Would you invest in Bitcoin today? Let me know in the comments!

References & Sources

Below is the lists of sources that I have used to write this article:

- Bloomberg: Bitcoin ETF Impact

- Ark Invest Big Ideas

- Fidelity’s Bitcoin Outlook

- CoinGecko Historical Data

Disclaimer

This is not a Sponsored post & the purpose of this article is only education. By reading this, you agree that the information of this blog article is not crypto investing advice. Do your own research before making any financial decision. Therefore, if you lost any money, localhost/bloghub/ will not be liable for this.